PAYCHECK PROTECTION PROGRAM (PPP) COMPLETE GUIDE:

PAYCHECK PROTECTION PROGRAM (PPP) COMPLETE GUIDE:

(Updated April 8th, 2020 @ 8:56am)

There are a lot of questions stirring out there regarding the different relief programs available to small businesses. In this article, we are going to focus on the Paycheck Protection Program, also known as PPP. We know that some people are visual learners so we’ve created a supplement infographic for those non-readers out there! Let me share with you what we know so far about the $349 billion “Paycheck Protection Program” (PPP) forgivable loans promised by the $2 trillion CARES Act passed last week. The information below is a combination of knowledge found in this government document, as well as talking with bank lenders, CPA’s, SBA loan officers, and attorneys. Even as I write this there is still information flowing down the pipe, so I will update this as new information is provided. With that said, this should be one of the most comprehensive guides to the paycheck protection program available on the internet. Enjoy!

The PPP forgivable loans are available through financial institutions that are certified lenders in the SBA’s 7(a) program. However, the program is expanding to other banks, credit unions, and the farm credit system institution that have signed up for the program.

Typically, you’d need to go through a certified lender with the SBA but considering those lending partners only make an average of $25 billion in SBA-guaranteed loans a year; they had no choice but to expand the program. Treasury knows it’s a big task for lending partners to process $349 billion over the next 3 months! With that said, we know you have some immediate questions so let’s get to it.

Where to find lenders handling PPP forgivable loans?

Where to find lenders handling PPP forgivable loans?

Start With Your Local Bank

I would start with your local community or commercial bank that you already have a relationship with. A lot of banks are being inundated with payment protection program loan applications right now and they are going to be taking care of their current customers first. I personally don’t blame them. There are a lot of options in the market when choosing a bank to open an account with and I want to be a priority with the bank I chose to do business with. I’ve always loved smaller community banks for the personal relationships you can build and this COVID-19 pandemic is another example of why that’s still important. I have checking accounts for different companies with both Enterprise Bank and Trust of Kansas City, as well as Bank of America. I have received personal interaction from the staff at Enterprise Bank and Trust (Enterprise puts the TRUST in banking) throughout this process while I haven’t been able to even get anyone on the phone (or reply to my emails) from Bank of America. In addition, Bank of America’s online PPP application informs you that you aren’t qualified to submit an application if you don’t have a business checking account AND a line of credit with them (i.e. business loan, business credit card, etc.). After nearly 20 years with Bank of America, this is the straw that finally broke the camels back and I will be moving all my accounts to another financial institution that can show me they appreciate my business. I’ve tolerated Bank of America because there is a branch on every corner but with banking starting to go more and more digital, that is a diminishing convenience factor anyhow. The large banks (Chase, Wells Fargo, and Bank of America) have a black eye after the mishandling of the initial PPP application launch. If you want to see some of the turmoil taking place, then I invite you to check out this article. As of April 7th, 2020 Wells-Fargo has closed their PPP loan applications.

Alternative PPP Lenders Available

You have options, so don’t worry. There are services such as Nav (Nav helps business owners find the right business financing matched to their needs) that has rolled out a digital PPP loan application to help match you with lenders processing payment protection program applications. Another option is Kabbage (a company providing direct funding to small businesses) that launched their paycheck protection program application on April 3rd, to facilitate funding.

We asked Scott Stewart the CEO of (ILPA) Innovative Lending Platform Association (an organization representing a diverse group of online lending and service companies serving small businesses) whether or not fintech companies would be participating in processing PPP loans and he had this to say:

Online small business lenders like the members of the Innovative Lending Platform Association (including Kabbage and OnDeck) are eligible to participate in underwriting and originating PPP loans, however, the SBA as of April 4th has yet to provide those companies with a process to apply to become a lender for the program. We hope that this will come soon since fintech lenders are best positioned to move money into the hands of small business borrowers within hours.

Here’s who is Eligible for PPP Loans

Here’s who is Eligible for PPP Loans

Eligible companies are startups with payroll, small businesses, 501(c)(3) nonprofits, 501(c)(19) veterans organizations, or tribal businesses that have fewer than 500 employees, with some limited higher thresholds for certain industries based on SBA guidelines. Applications officially opened April 3, 2020.

In addition, individuals who operate a sole proprietorship or as an independent contractor and self-employed individuals are eligible — the CARES Act says their monthly payroll amount will be based on the gross income on their most recently filed tax return or any 1099s they can submit as documentation to the lender they are working with. That means self-employed individuals will be able to apply for a PPP loan to pay themselves! With that said, those applications won’t be accepted until April 10th, so if you fall into this category you will want to be prepared and file as early as possible. From what I understand, it appears that self-employed individuals can apply for a Paycheck Protection loan OR the newly expanded unemployment benefits, but not both, so consider which makes the most sense for your situation. Although eligible businesses are those with fewer than 500 employees it does appear that there is a provision allowing businesses in the food or hospitality industry to be excluded from this as long as they have less than 500 employees per physical location.

How can I prepare myself? What does the application look like?

Have your payroll records ready for the 2019 calendar year, as well as the last 12 months going back from March 31, 2020. There is a lot of different information out there and how your average monthly payroll will be calculated. Some lenders are telling us that they will use the 2019 calendar year while others are telling us they are using the past 12 months starting from March 31, 2020. If you are a seasonal business then they will use your average payroll between 2/15/2019 – 6/30/2019. If you just started your business, they will ask for payroll for January-March of 2020. To be safe, have it all ready. Requirements are still coming down the funnel, so ask your lender and/or your CPA which historical payroll data is appropriate for your business in order to calculate your average monthly payroll expense. If you use a service such as Gusto.com (a platform for helping businesses pay, insure, and support their employees) then it’s super easy to export exactly what you need for payroll documentation to process the PPP loan. If you are looking for a better payroll solution then do yourself a favor and drop what you are doing and go get signed up.

![]() The maximum Paycheck Payment Protection Program (PPP) loan size will depend on your unique business situation.

The maximum Paycheck Payment Protection Program (PPP) loan size will depend on your unique business situation.

Regular Business with 12-month Payroll: If you were in business prior to February 15, 2019, then most bank lenders are asking for your average monthly payroll for the calendar year of 2019. Your max loan is equal to 2.5x your average monthly payroll costs. (Example: Your average monthly payroll costs are $10,000 during this time period. You would take $10,000 x 2.5 = $25,000. So $25,000 would be your loan amount eligibility.)

Seasonal Business: If you are a seasonal business then you can use February 15, 2019 – June 30, 2019, to get your average monthly payroll. Your max loan is equal to 2.5x your average monthly payroll costs.

New Business without 12-month Payroll: If you were not in business between February 15, 2019 – June 30, 2019, you would calculate your average payroll expense between January 1, 2020, and February 29, 2020. Your max loan is equal to 2.5x your average monthly payroll costs.

If you took out an Economic Injury Disaster Loan (EIDL) from the SBA between February 15, 2020, and June 30, 2020, and you want to refinance that loan into a PPP loan, you would add the outstanding loan amount to the 2.5x average payroll sum. Keep in mind there is an overall cap of $10 million per PPP loan.

It is possible to borrow more in a PPP than is eligible to be forgiven so speak with your lender to calculate how much of the loan is forgivable.

*Note: The important thing to know here is that your lender will tell you what payroll range you should be providing for them to process your loan.

Calculating the Size of Your Loan

Calculating the Size of Your Loan

Payroll costs for the purpose of calculating the size of the loan you are eligible for include: Compensation including salaries, wages, commissions, payment of cash tips or equivalent, and independent contractor payments* (notice the independent contractor payment asterisk, keep reading).

This also includes payments for vacation, parental, family, medical or sick leave, and severance pay. Payments for group health care benefits, including insurance premiums, retirement benefits, and state or local taxes assessed on employee compensation are also eligible. Your employer can request a PPP forgivable loan that includes lost tips and with the current ruling as of the employer can use records or “a reasonable good-faith estimate” of tips.

Can You Include Independent Contractor Payments?

The short answer is “No“. Lenders now have guidance from the SBA in regard to the initial rule that came out allowing businesses to include independent contractor payments in their PPP loan application. As of now, you can only include W-2 payroll for your PPP loan as sole proprietors and independent contractors can apply for the PPP themselves. In regards to your W-2 payroll if you have a reduction in the payroll of 25% or more for any employee that made less than 100k annualized then your loan forgiveness will also be reduced. The most attractive aspect of the PPP loan is that it’s forgivable so don’t take on more debt unnecessarily if you don’t need it.

What makes this even more tricky is that independent contractors can apply for their own PPP loans to pay themselves, so it will be interesting to see how this shakes out.

What Does PPP Loan Cover Besides Payroll?

PPP forgivable loans can also cover interest payments on a business’s mortgage obligation (not principal), rent, utilities, and interest on any other debt obligations that were incurred before February 15, 2020.

*Important Note: If you are applying for the COVID-19 Economic Injury Disaster Loan Application please be aware that although perfectly fine to take advantage of both programs, make sure that you don’t use the funding for the same thing. I’d recommend you use the PPP loan to cover payroll as that is the original intention and use your COVID-19 EIDL loan for other shortfalls you have due to the COVID-19 impact on your business.

![]() There are some costs that aren’t eligible to include in a PPP loan and you should be aware of those.

There are some costs that aren’t eligible to include in a PPP loan and you should be aware of those.

Non-eligible payroll costs include any employee wages or compensation over $100,000. Taxes imposed or withheld for payroll taxes, railroad taxes and retirement benefits, and income taxes withheld on wages. You also can’t include employees payroll who principally live outside the United States (sorry Web Dev Shops!). Qualified sick and family leave for which a credit is available under sections 7001 and 7003 of the Families First Coronavirus Response Act, a separate law that offered tax credits for paid sick leave under certain conditions.

*Fun Fact: PPP forgivable loans do not require personal guarantees or collateral!

![]() There is a pretty straight forward formula for calculating your PPP forgiveness amount.

There is a pretty straight forward formula for calculating your PPP forgiveness amount.

It is 8-weeks of payroll, plus rent or mortgage interest payments, plus utility bills paid in the first eight weeks after being approved for your loan. In order to get this amount, you must verify you did indeed pay those costs eligible for the forgiveness amount. After you have been approved for the PPP loan there will be a second application down the road for applying for the forgiveness of these funds. You will want to apply with your lender for loan forgiveness 8 weeks after getting approved for your loan, with the necessary documentation to prove you spent the loan proceeds on eight weeks of payroll, rent, or mortgage interest and utilities. Your individual lender then has 60-days to verify and process the loan forgiveness applications. If a business has maintained the employee headcount it had as of February 15, 2020, it will get the full forgiveness amount. If the headcount is less than that, loan forgiveness will be reduced according to another formula. Independent contractors do not count for loan forgiveness calculation purposes (except when applying for themselves, of course).

![]() Any remaining PPP amount balance not covered by your PPP forgiveness amount will be due over a term of 2 years, at an interest rate of 1 percent.

Any remaining PPP amount balance not covered by your PPP forgiveness amount will be due over a term of 2 years, at an interest rate of 1 percent.

The payments are deferred for 6 months from the time you are approved, but keep in mind that interest will still accrue during this 6-month deferment period.

![]() There is a nationwide cap of $349 billion on PPP loan forgiveness, although we are hearing whispers of the government increasing this amount if necessary. Again, there is no sure thing they will do that so get your application submitted asap.

There is a nationwide cap of $349 billion on PPP loan forgiveness, although we are hearing whispers of the government increasing this amount if necessary. Again, there is no sure thing they will do that so get your application submitted asap.

It will be first-come, first-served. This means if you own, operate, or work at an eligible small business or nonprofit, contact an SBA lender immediately.

The regulations are not finalized yet, so it’s not 100 percent clear to the lenders I’ve interviewed what documentation will be necessary for these loans or, later, for loan forgiveness. It’s the biggest question on their minds right now, because more documentation means less chance of fraud, meaning more assurance workers will benefit as promised. But the more documentation needed, the slower the process tends to be. It’s a balance that has to be struck. In general, for loan applications expect to bring any documentation of eligible payroll costs paid in the past year or before February 15, 2020, including independent contractor payments (for now). For loan forgiveness, which requires a separate application eight weeks after receiving a PPP loan, bring documentation of payroll paid, plus documentation for any lease or mortgage interest payments, and utility bill payments.

Pro-Tips to Help Now and Beyond

Pro-Tips to Help Now and Beyond

Brex Corporate Card

If you are a tech-startup with cash flow, consider signing up for a corporate business card like www.brex.com. There’s no personal guarantee required and there it’s interest-free net 30-day terms! You can also get higher credit limits and better rewards than any competing card in the market. This is helpful if you have net-30 day payment terms with your own clients or need to push some of those cash expenses interest-free for 30-days. In addition, if you put “Lula” in the field for “How did you hear about Brex” then both companies will be sent a $500 Amazon Gift Card once you spend your first $1,000 on your new Brex Card.

Gusto Payroll

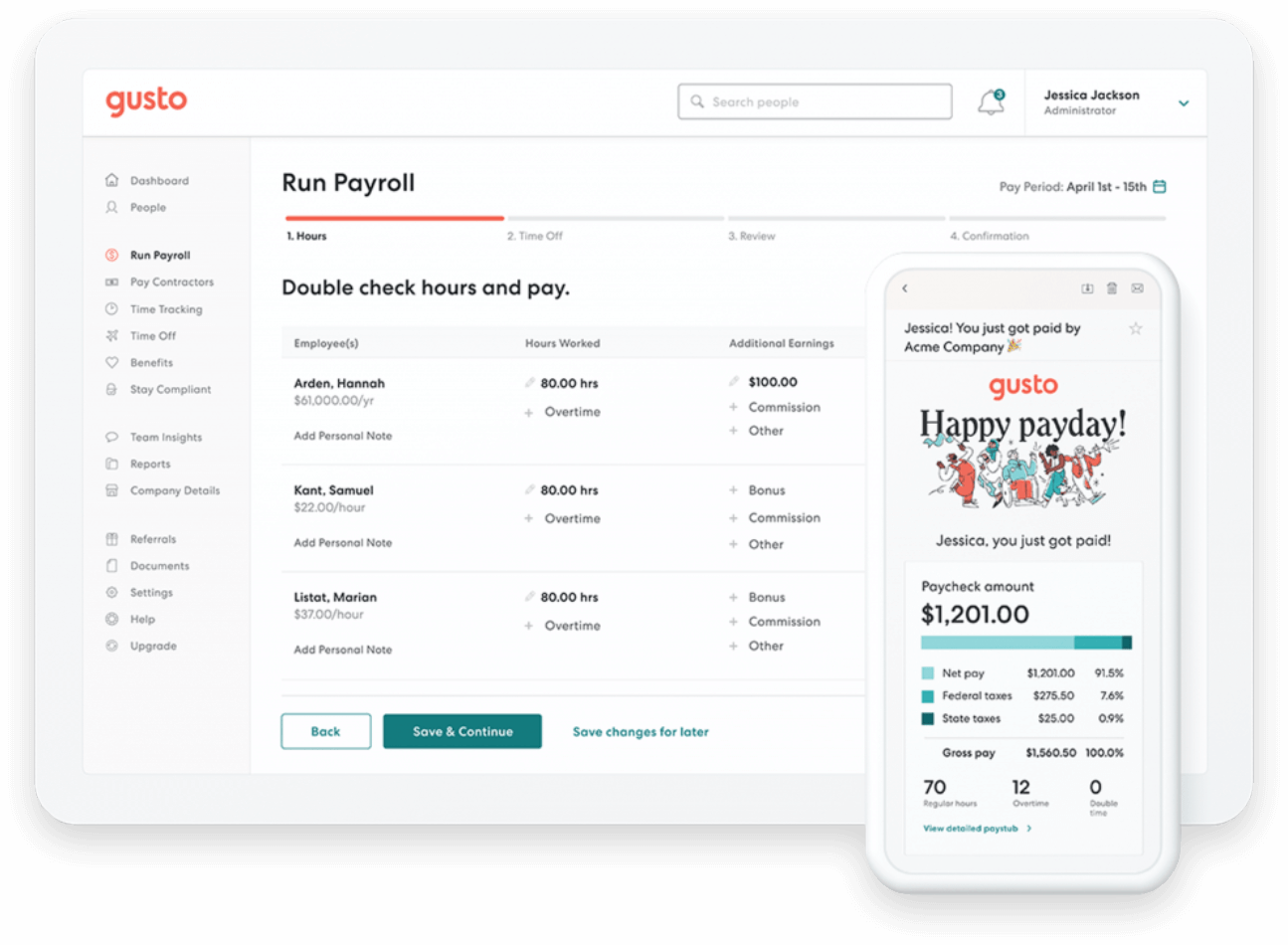

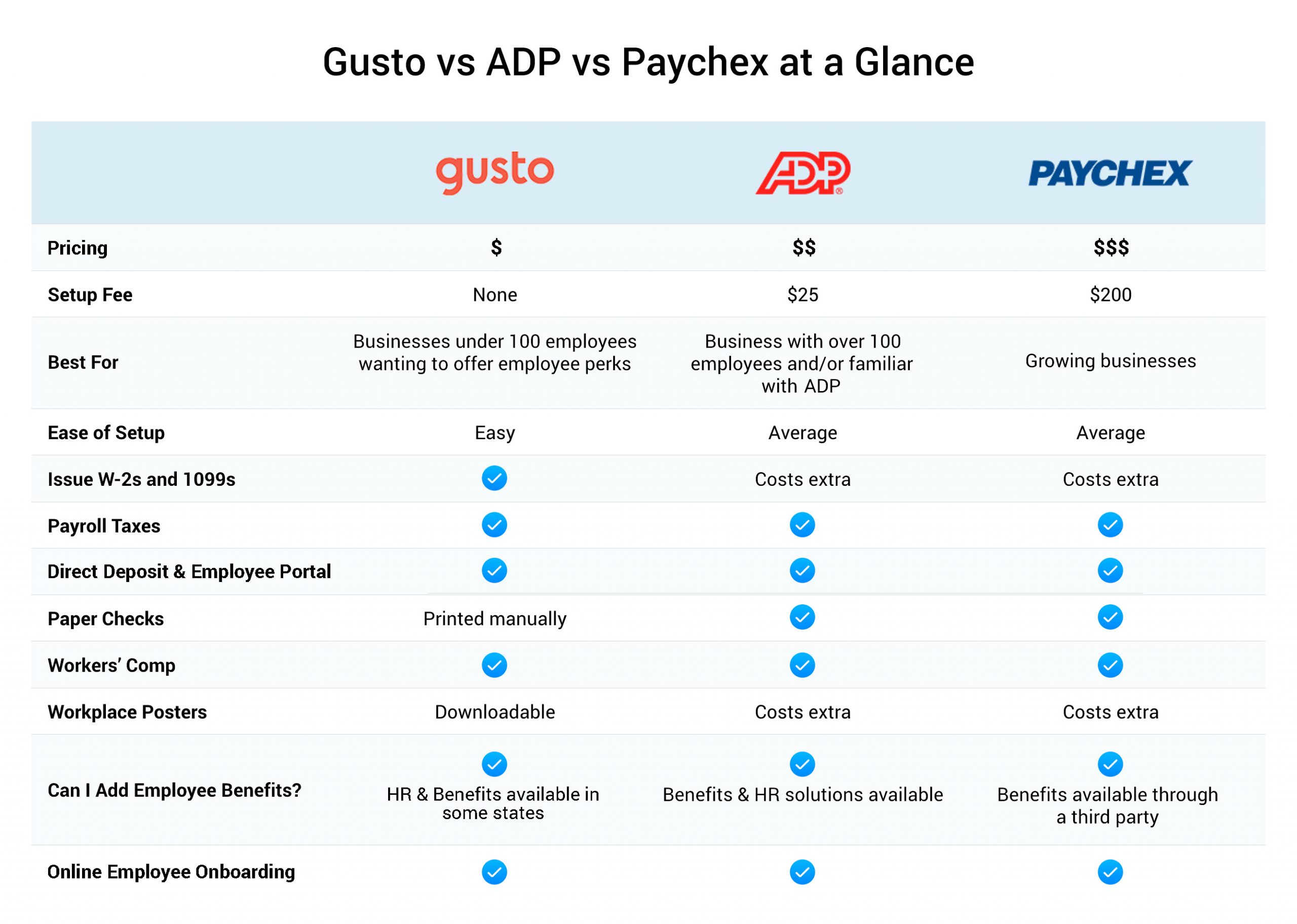

I’ve had multiple businesses handling payroll in different ways. We’ve handled payroll with Quickbooks, we’ve used Paychex, and finally tried Gusto. If you want a competitively priced payroll solution that puts everything on auto-pilot for you then look no further than Gust. Gusto is an amazing company that provides a cloud-based payroll, benefits, and human resource management software for startups and small businesses. They are constantly innovating and adding additional features and programs to help streamline your employee experience. Gusto’s customer support is very responsive and incredibly helpful. The actual Gusto platform is extremely intuitive and they’ve handled this COVID-19 situation with complete class.

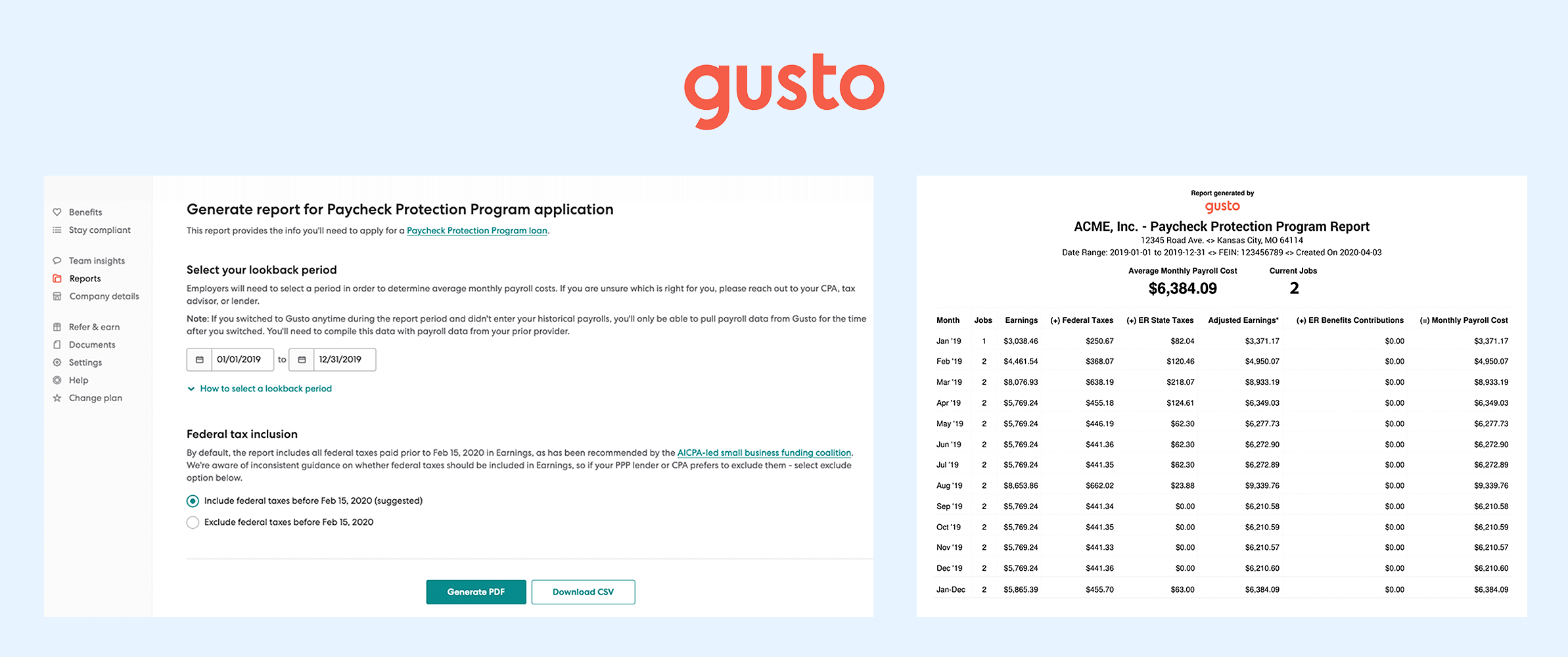

We’ve used Gusto for onboarding new employees and payroll for over 2 years now and never had any issue. Gusto takes care of all your tax filing and payments for you, so you stay compliant. Their real-time reporting area is second to none and they even created an entire section related to COVID-19 specifically for the Paycheck Protection Program (PPP). You basically click the easy button and they generate a payroll report for you that’s required by your SBA lender to process your PPP loan. With Gusto’s base plan you can spend as little as $6/month for every employee after their friendly base fee of $39/m. Get the best payroll solution on the market here.

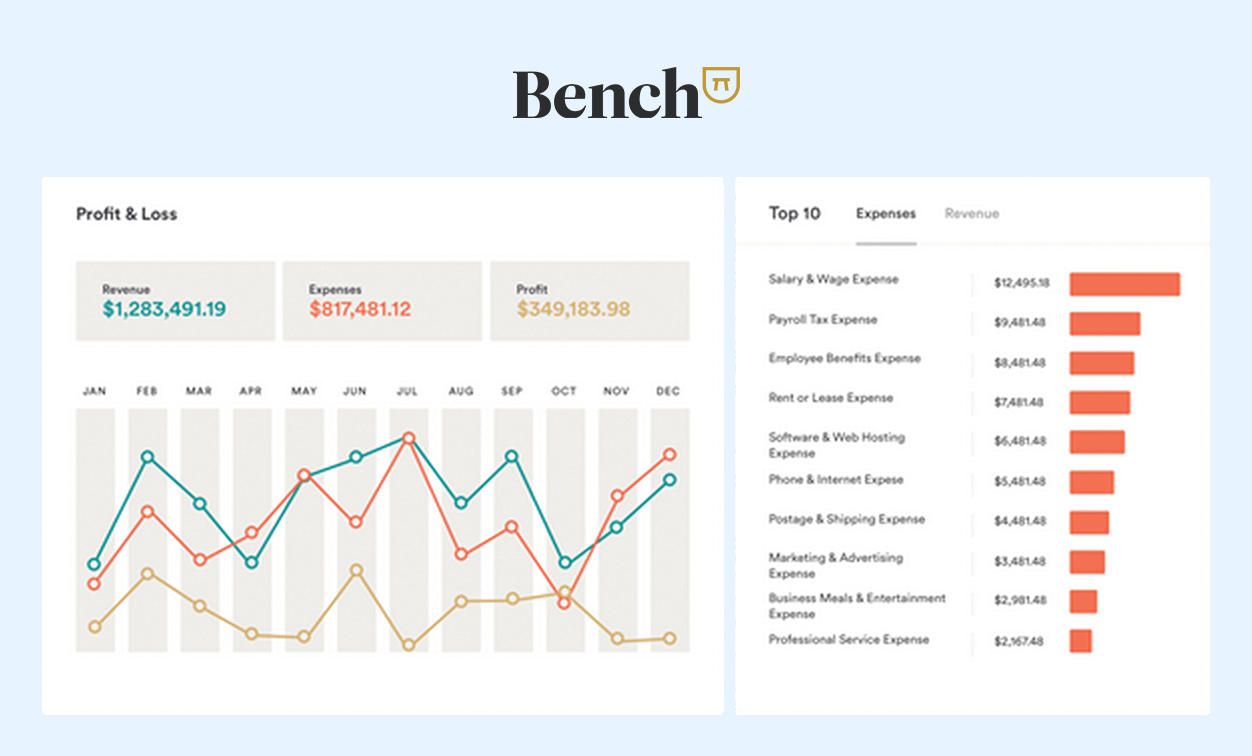

Bench Bookkeeping

Bench pairs you with a team of professional bookkeepers to do your bookkeeping, leaving you to run your business. They have a real-time financial reporting dashboard and reports you can export at any time. This was amazing for when we applied to the COVID-19 Economic Disaster Injury Loan (EDIL) as our profit and loss statements and balance sheets required for the loan process were ready to go already! Sign up using this link within the next 30 days and Bench is offering $150 gift card and up to $400 in savings for the new account. Their support is fantastic!

The Founders Collective

If you are a startup based in the Kansas City area then you can join the non-profit organization that helps educate early-stage founders, and leverages each other’s network to better succeed in the entrepreneurial eco-system. In addition, if you are accepted into the organization there are over $1M in free perks to help eliminate many expenses in your first 1-2 years of business. If you are a Kansas City startup, then sign up take and advantage of this now.

This information was collected by individuals of their trade (i.e CPA’s, Bankers, SBA Loan Officers, Payroll Officers, and .Gov). This is obviously a developing story so we will try to update this content as more information becomes available. Anything found written in this article was written solely for informational purposes. We advise that you receive professional advice if you plan to move forward with any of the information found. You agree that neither Lula or the author are liable for any damages that arise from the use of the information found within this article.

Anything found written in this article was written solely for informational purposes. We advise that you receive professional advice if you plan to move forward with any of the information found. You agree that neither Lula or the author are liable for any damages that arise from the use of the information found within this article

Fantastic breakdown of the Paycheck Protection Program! Your post on Lula.life is a lifesaver for small businesses like mine. Clear, concise, and immensely helpful. Thanks a bunch!

Thank you!